iowa capital gains tax exclusion

The deduction must be reported on one of six forms by completing the applicable Capital Gain. For the sale of business property to be eligible the taxpayer.

What Changes Are Coming To The Iowa Tax Landscape And When

The Iowa capital gain deduction is subject to review by the Iowa Department of Revenue.

. Iowa has a unique state tax break for a limited set of capital gains. Iowa does not tax capital gains resulting from the sale of property used in trade or business for at least 10 years. Iowa capital gains exclusion - Iowa Blog 1 week ago You can sell your primary residence exempt of capital gains taxes on the first 250000 if you are single and 500000 if married.

A copy of your federal Schedule D and federal form 8949 if applicable must be included with this return if. This provision applies to tax years beginning on or after January 1 2023. Just like with income tax the capital gains tax is not a flat fee.

See Tax Case Study. Enter 100 of any capital gain or loss as reported on federal form 1040 line 7. Effective with tax year 2012 50 of the gain from the saleexchange of employer.

The various types of sales resulting in capital gain have specific guidelines which must be met to qualify for the Iowa capital gain deduction. Enter 100 of any capital gain or loss as reported on federal form 1040 line 7. Installments received in the tax year from installment sales of businesses are eligible for the exclusion of capital gains from net income if all relevant criteria were met at the.

Introduction to Capital Gain Flowcharts. Iowa law Iowa Code 4227 21 provides that certain capital gains can be excluded from taxable income. Gains from the sale of stocks or bonds do not qualify for the deduction with the following exception.

Installments received in the tax year from installment sales of businesses are eligible for the exclusion of capital gains from net income if all relevant criteria were met at the. Iowa tax law provides for a 100 percent deduction for qualifying capital gains. When a landowner dies the basis is automatically reset.

The most basic of the qualifying elements for the deduction requires the ability to count to 10 or. If line 6 of the IA 1040 includes a capital gain transaction you may have a qualifying Iowa capital gain deduction. Beginning in tax year 2023 Iowa farmers age 55 and older who farmed for at least 10 years but have retired from farming operations can elect an exemption of income from either cash rent.

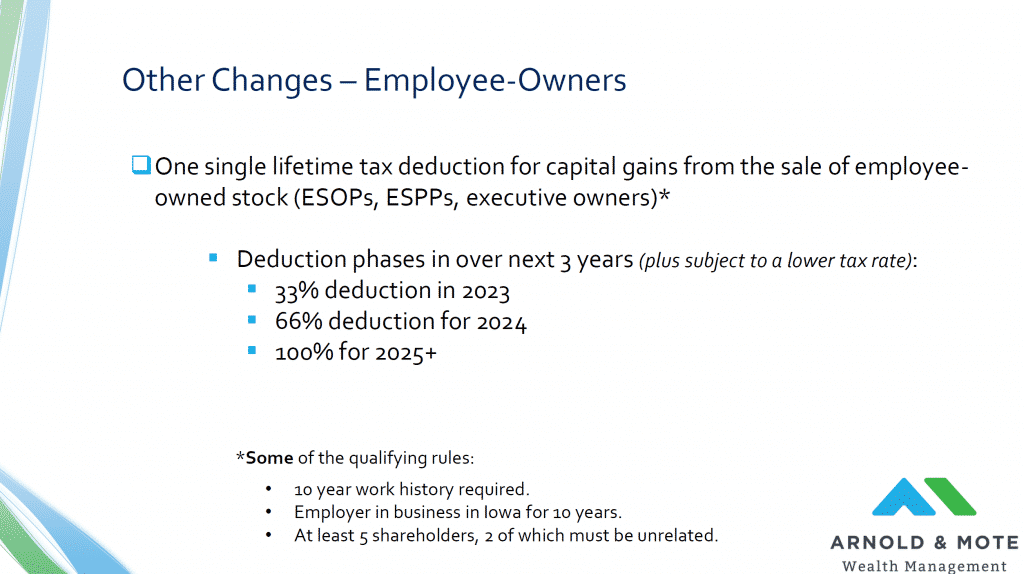

Certain sales of businesses or business real estate are excluded from Iowa taxation but only if they meet two. Recent Tax Reduction and Action However 2018 legislation slightly reduced the states personal income and individual capital gains tax rate from 898. The law modifies the capital gain deduction.

The Iowa capital gain deduction is subject to review by the Iowa Department of. The capital gains deduction has a fairly brief history on the Iowa 1040 Individual Income Tax Form. IA 100A - IA 100F Capital Gain Deduction Information and Links to Forms Instructions 41-161.

The tax rate on most net capital gain is no higher than 15 for most individuals. If you sold the stock youd owe a capital gains tax on 65 profit per. A copy of your federal Schedule D and federal form 8949 if applicable must be included with this return if.

This provision is found in Iowa Code 422721. Some or all net capital gain may be taxed at 0 if your taxable income is less than 80000. For sales made on or after January 1 1990 Iowa taxpayers could claim a 45 deduction.

Division III Retired Farmer Capital Gain Exclusion. How are capital gains taxed in Iowa.

State Taxes On Capital Gains Center On Budget And Policy Priorities

Tax Changes Hold Important Decision For Iowa Farmers State Regional Agupdate Com

Iowa Governor Signs Tax Reform Into Law Center For Agricultural Law And Taxation

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management

State Corporate Income Tax Rates And Brackets Tax Foundation

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

State Taxes On Capital Gains Center On Budget And Policy Priorities

Will 2022 Bring New Tax Law Center For Agricultural Law And Taxation

2021 Iowa Legislative Session Ends With Flurry Of New Tax Rules

Iowa Lawmakers Pass Massive Tax Cut Iowa Capital Dispatch

Capital Gains Tax Iowa Landowner Options

Iowa Capital Gain Exclusion Inapplicable To Sale Of Partnership Interest Center For Agricultural Law And Taxation

State Taxes On Capital Gains Center On Budget And Policy Priorities

Iowa Tax Reform Details Analysis Tax Foundation

Iowa Legislature Sends Significant Tax Bill To The Governor Center For Agricultural Law And Taxation

How High Are Capital Gains Taxes In Your State Tax Foundation